Securities class actions are legal mechanisms protecting investors' rights, ensuring fairness and accountability in the securities market. With a focus on the Right to a Fair Trial under the U.S. Constitution, these cases address fraud and misconduct, driving regulatory changes for transparency. Balancing investor protection and due process involves structured legal frameworks, meticulous documentation, and strategic navigation of complex laws. Technological advancements and criminal defense strategies can enhance efficiency, discovery, and risk assessment in these high-stakes battles, ultimately fostering ethical business conduct and investor confidence.

Securities class actions play a pivotal role in protecting investors and shaping the financial industry. This comprehensive guide explores the intricate world of securities litigation, focusing on key aspects such as understanding the legal framework, constitutional protections for fair trials, crucial elements of successful lawsuits, and the significant impact of these cases. We delve into the challenges faced and future prospects, offering valuable insights into investor protection in today’s dynamic market.

- Understanding Securities Class Actions: An Overview of Legal Framework

- The Right to a Fair Trial: Constitutional Protections and Their Relevance

- Key Elements of a Successful Securities Class Action Lawsuit

- Impact and Outcomes: How These Cases Shape the Financial Industry

- Navigating Challenges and Future Prospects for Investor Protection

Understanding Securities Class Actions: An Overview of Legal Framework

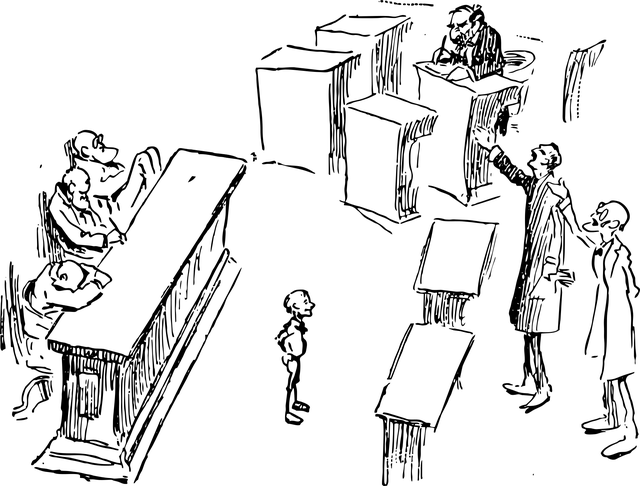

Securities Class Actions are a legal mechanism designed to protect investors by holding companies and individuals accountable for fraud or misconduct in the securities market. Understanding this process is crucial, as it ensures the right to a fair trial, a principle enshrined in the Constitution. This right is particularly important in cases involving complex financial matters, where investors might be vulnerable to manipulation.

The legal framework governing these actions provides a structured approach, guiding plaintiffs and defendants through all stages of the investigative and enforcement process. This includes meticulous documentation, thorough investigations, and fair adjudication. The involvement of both philanthropic and political communities in shaping securities laws further underscores the significance of maintaining integrity in financial transactions. Moreover, white-collar defense strategies play a critical role in navigating these legal battles, ensuring that companies can defend themselves fairly while adhering to stringent regulatory standards.

The Right to a Fair Trial: Constitutional Protections and Their Relevance

In high-stakes cases, such as securities class actions, the right to a fair trial is paramount. Constitutional protections play a pivotal role in ensuring that individuals accused of white collar offenses receive a just and impartial adjudication. The U.S. Constitution guarantees various rights that are essential for a fair trial, including the right to due process and the protection against self-incrimination. These provisions safeguard defendants from arbitrary state action and ensure that evidence is presented fairly and transparently.

For plaintiffs’ attorneys and defendants alike, understanding these constitutional safeguards is crucial when navigating complex legal battles. In cases where the allegations are grave and the financial implications immense, a complete dismissal of all charges may hinge on the application and interpretation of these rights to a fair trial. It’s in these high-stakes scenarios that the relevance of constitutional protections truly comes to the forefront.

Key Elements of a Successful Securities Class Action Lawsuit

A successful securities class action lawsuit hinges on several key elements that ensure a fair and just outcome for all involved parties. First and foremost, plaintiffs must establish that they have been harmed by a company’s misconduct; this demonstrates standing, a fundamental prerequisite for any legal action. The ability to aggregate similar claims into a single suit is another crucial aspect, facilitated by the right to a fair trial as guaranteed by the Constitution. This collective approach allows for significant resources to be marshaled efficiently, enhancing the chances of achieving extraordinary results and holding wrongdoers accountable.

Additionally, an unprecedented track record of success in similar cases can bolster the strength of the lawsuit. Demonstrating prior victories not only enhances credibility but also serves as compelling evidence that the claims are valid and deserving of careful consideration. By presenting a well-reasoned argument, robust evidence, and a strategic plan for navigating the legal complexities, plaintiffs can avoid indictment and secure favorable settlements or verdicts.

Impact and Outcomes: How These Cases Shape the Financial Industry

Securities class actions have a profound impact on shaping the financial industry. These cases, often driven by allegations of fraud or misconduct, serve as a powerful check against corporate abuse and protect investors’ rights. The outcomes of such litigation can lead to significant changes in regulatory frameworks, enhancing transparency and accountability within the industry. By holding companies and individuals accountable for white-collar and economic crimes, these actions contribute to the larger goal of maintaining fair market practices.

The Right to a Fair Trial, enshrined in the Constitution, plays a crucial role in these cases. It ensures that corporate clients and individual defendants alike receive a thorough and just hearing. This balance is vital for upholding the integrity of financial markets and instilling confidence among investors. As a result, securities class actions not only provide restitution for victims but also act as a deterrent, discouraging similar misconduct and fostering a culture of ethical business conduct.

Navigating Challenges and Future Prospects for Investor Protection

Navigating Challenges and Future Prospects for Investor Protection

Securities class actions present unique challenges in ensuring investor protection, often caught between the need to deter wrongdoings and safeguard against frivolous lawsuits. One significant challenge lies in balancing the right to a fair trial for both investors and defendants. As these cases can involve complex financial transactions and intricate legal arguments, ensuring a thorough investigation and proper due process is paramount. This requires robust mechanisms to prevent abuse while maintaining transparency and fairness.

Looking ahead, advancements in technology and data analytics offer promising prospects for enhancing investor protection. Efficient case management systems, improved discovery processes, and sophisticated risk assessment tools can aid in identifying patterns of misconduct more effectively. Furthermore, integrating principles from general criminal defense and white-collar defense strategies could provide additional safeguards, ensuring that legal proceedings are conducted with integrity while still holding wrongdoers accountable.

Securities class actions play a pivotal role in protecting investors’ rights and shaping the financial industry. By understanding the legal framework, ensuring constitutional protections, and defining key elements of successful lawsuits, these cases safeguard fair trials. The impact extends beyond individual outcomes, as they contribute to enhancing investor protection and revolutionizing the way the financial sector operates. As we navigate challenges and look towards future prospects, it’s crucial to continue fostering a robust system that upholds the right to a fair trial, ensuring investors have a voice in holding corporations accountable.