Understanding your Right to a Fair Trial, as protected by the Constitution, is crucial for combating securities scams in today's complex financial market. By staying informed and exercising critical thinking, investors can defend themselves, promote transparency, and ensure justice through regulatory measures and educational resources from bodies like the SEC and non-profit organizations.

In the realm of securities, understanding your legal rights and spotting scams is crucial for a fair financial journey. This article delves into the intricate balance between investor protection and market integrity, highlighting common securities scams and historical examples that serve as cautionary tales. We explore how regulatory measures protect investors and provide essential resources for navigating the financial landscape safely. By examining the role of the Constitution in ensuring the right to a fair trial, readers gain valuable insights for safeguarding their investments.

- Understanding Your Legal Rights: The Constitution's Role

- Common Securities Scams: How to Spot Them

- Protecting Investors: Regulatory Measures in Place

- Historical Examples: Lessons from Past Scams

- Staying Informed: Resources for a Safe Financial Journey

Understanding Your Legal Rights: The Constitution's Role

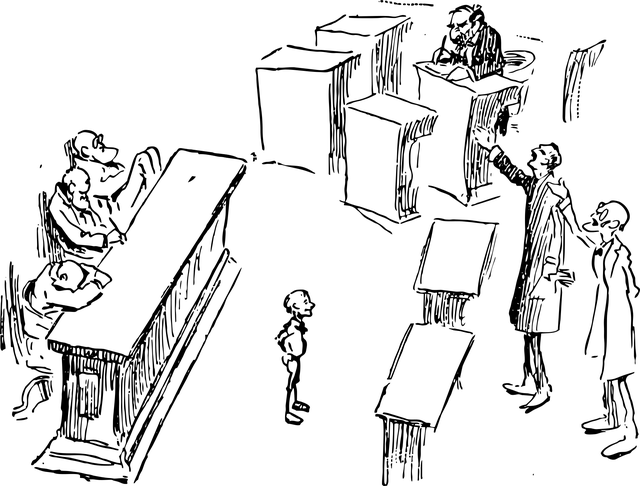

Understanding your legal rights is paramount when navigating high-stakes cases involving white collar and economic crimes. The Constitution guarantees every individual the right to a fair trial, ensuring that accused persons have access to justice and protection from arbitrary or unfair prosecution. This fundamental principle plays a crucial role in countering securities scams by providing a framework for due process and safeguarding against unprecedented track records of injustice.

In such cases, where complex financial schemes are at play, the right to a fair trial becomes even more vital. It ensures that the legal system upholds integrity, transparency, and accountability, making it a powerful tool in deterring and exposing securities scams. By understanding these rights, individuals can better protect themselves and hold perpetrators accountable, fostering a culture of fairness and justice in the financial sector.

Common Securities Scams: How to Spot Them

In today’s financial landscape, understanding common securities scams is crucial to protecting your Right to a Fair Trial as guaranteed by the Constitution. Scammers often target investors with promises of quick wealth and extraordinary results, preying on their desire for financial freedom. These con artists may use high-pressure sales tactics, false documentation, or even impersonate regulatory bodies to gain trust. They might offer investment opportunities in non-existent or highly speculative ventures, enticing unsuspecting individuals with the allure of easy money.

To spot these scams, it’s essential to remain vigilant and critically assess any investment proposals that seem too good to be true. Research thoroughly before investing, checking the background of those offering the opportunity, especially in cases involving white-collar and economic crimes. Be wary of aggressive sales tactics or promises of guaranteed returns. Remember, achieving extraordinary results is rarely achieved without significant risk, and legitimate opportunities rarely involve high pressure to act immediately.

Protecting Investors: Regulatory Measures in Place

In an era where financial markets are increasingly complex, protecting investors from deceptive practices is paramount. Regulatory bodies have implemented stringent measures to safeguard investors’ rights and ensure fair trading practices. These regulations are designed to foster transparency, deter fraudulent activities, and provide a robust framework for dispute resolution. One of the fundamental principles is the Right to a Fair Trial, enshrined in the Constitution, which allows investors to seek justice and redress when scammed by securities fraudsters.

The regulatory landscape across the country has an unprecedented track record in handling high-stakes cases, demonstrating its effectiveness in protecting investor interests. Through stringent oversight, market integrity is maintained, ensuring that financial markets operate with honesty and fairness. This proactive approach not only safeguards individual investors but also strengthens public confidence in the overall securities ecosystem.

Historical Examples: Lessons from Past Scams

Throughout history, securities scams have left a trail of destruction, serving as stark reminders of the importance of investor protection and fair practices. From the infamous Ponzi scheme orchestrated by Charles Ponzi in the 1920s, which promised investors unrealistic returns with no genuine investment strategy, to the more recent global frauds that have targeted unsuspecting individuals across the country, these incidents offer invaluable lessons.

Historical examples illustrate the far-reaching consequences of securities scams, often resulting in severe economic and reputational damage. As we navigate today’s complex financial landscape, understanding these past mistakes is crucial. The Right to a Fair Trial, enshrined in the Constitution, plays a pivotal role in ensuring that investors are protected from fraudulent activities and that perpetrators face justice. By learning from historical cases, regulators and investors alike can enhance vigilance, foster transparency, and build an unprecedented track record of preventing securities scams, thereby safeguarding the financial well-being of communities across the nation.

Staying Informed: Resources for a Safe Financial Journey

Staying informed is your first line of defense against securities scams. The right resources can help you navigate the complex financial landscape with confidence. Start by familiarizing yourself with regulatory bodies like the Securities and Exchange Commission (SEC) and their role in protecting investors through strict regulations and enforcement actions against fraudulent activities. These organizations provide extensive educational materials, consumer alerts, and scam-prevention tips accessible online.

Additionally, leveraging reputable news sources and non-profit organizations dedicated to financial literacy equips you with the knowledge to recognize potential red flags. Many of these entities offer workshops, webinars, and publications that delve into common scams, such as Ponzi schemes, pump-and-dump frauds, and binary options tricks, highlighting the telltale signs and strategies employed by scammers. By staying informed, you can exercise your right to a fair trial by making well-informed investment decisions, thereby safeguarding your financial future across the country and beyond, even within the philanthropic and political communities.

In navigating the complex world of securities, understanding your legal rights, recognizing common scams, and staying informed are essential steps towards protecting yourself. The Constitution’s role in ensuring a fair trial serves as a cornerstone for investor protection. By being aware of historical examples and leveraging available resources, investors can make informed decisions, steering clear of potential scams and securing their financial future.