The Right to a Fair Trial Constitution is vital in combating financial fraud by balancing deterrence with individual rights. Technological advancements and stricter regulations aid in fraud detection while robust security protocols within organizations prevent it. This integrated approach fosters transparency, efficiency, and economic security.

Financial fraud detection is a critical aspect of maintaining economic integrity. This article explores various dimensions of combating financial crimes, focusing on understanding fraud from a legal perspective, while balancing the Right to a Fair Trial guaranteed by the Constitution. We delve into advanced detection methods powered by technology and regulatory frameworks, alongside proactive measures to safeguard financial systems. By examining these components, we aim to highlight comprehensive strategies essential for prevention and justice in the face of financial fraud.

- Understanding Financial Fraud: A Legal Perspective

- The Right to Fair Trial: Protecting Individuals

- Detection Methods: Technology and Regulations

- Preventive Measures: Safeguarding Financial Systems

Understanding Financial Fraud: A Legal Perspective

Financial fraud is a complex issue that intersects with various legal domains, particularly in the realm of criminal law. From a legal perspective, understanding financial fraud involves recognizing the rights guaranteed to both corporate and individual clients under the Constitution. The right to a fair trial is a cornerstone in the fight against white-collar and economic crimes, ensuring that suspects are treated equitably throughout all stages of the investigative and enforcement process.

This delicate balance is crucial as it safeguards against arbitrary deprivations while enabling authorities to effectively combat fraudulent activities. Legal frameworks must be robust enough to deter potential perpetrators without infringing upon the rights of the accused, fostering a just and transparent system. By adhering to these legal principles, financial fraud detection can become a more efficient and effective process that protects both individuals and corporate entities from economic losses.

The Right to Fair Trial: Protecting Individuals

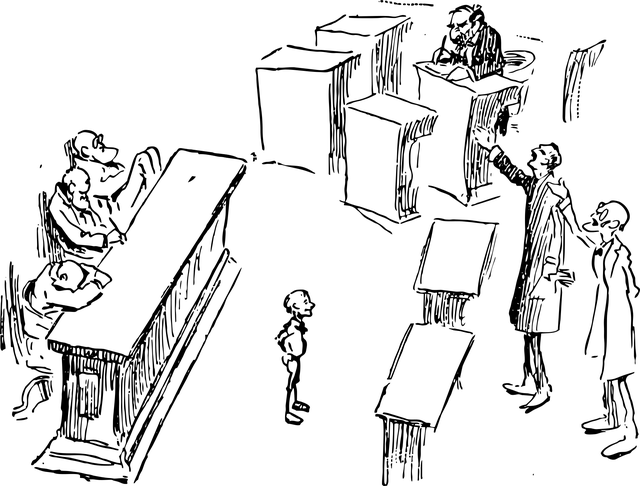

The Right to a Fair Trial, enshrined in the Constitution, plays a pivotal role in financial fraud detection by safeguarding individuals from unfair prosecution. This right ensures that anyone accused of a crime, including white-collar offenses like fraud, has the opportunity to defend themselves in a timely and impartial manner. In the context of financial fraud, where allegations can be complex and sensitive, this principle is essential to avoid unjust indictments and protect the rights of those who may have been falsely implicated.

A fair trial process involves several key elements: access to legal counsel, a neutral judge, the right to present evidence, confront accusers, and an impartial jury. These safeguards are designed to prevent arbitrary or abusive prosecutions, ensuring that the burden of proof lies with the prosecution. For his clients facing financial fraud accusations, having robust white-collar defense strategies in place is crucial to navigating this complex landscape while upholding their Right to a Fair Trial.

Detection Methods: Technology and Regulations

The detection of financial fraud has evolved significantly with advancements in technology and a heightened regulatory landscape. Modern tools such as artificial intelligence (AI) and machine learning are now employed to analyze vast datasets, identify patterns, and predict potential fraudulent activities. These technologies can sift through complex financial transactions at speeds unattainable by manual methods, making them powerful allies in the fight against fraudsters.

Regulatory bodies worldwide have also introduced stringent measures, such as enhanced reporting requirements and stricter oversight, to ensure transparency and accountability in various business sectors. The Right to a Fair Trial Constitution plays a crucial role here, balancing the need for effective fraud detection with the protection of individuals’ rights. By combining these technological advancements and regulatory frameworks, financial institutions can navigate the respective business environments while avoiding indictment and winning challenging defense verdicts, ultimately fostering a more secure and trustworthy economic ecosystem.

Preventive Measures: Safeguarding Financial Systems

Preventive measures play a pivotal role in financial fraud detection, ensuring that systems are robust and fair. Organizations must implement stringent security protocols to safeguard their financial data, adhering to legal standards set by the Right to a Fair Trial Constitution. This involves regular system audits, employee training on ethical practices, and advanced cybersecurity solutions to protect against unauthorized access and data breaches. By adopting these measures, institutions can significantly reduce the risk of fraud, fostering an environment that makes white-collar and economic crimes less appealing.

Moreover, proactive strategies like robust internal controls, separate check systems, and transparent accounting practices help in avoiding indictment in cases of suspected financial misconduct. A general criminal defense strategy that focuses on preventive measures can offer a more effective approach to combating fraud, ensuring that organizations remain compliant and their financial landscapes are secure.

In conclusion, financial fraud detection is a multifaceted challenge that requires a blend of technological advancements, robust regulatory frameworks, and a strong commitment to individual rights, particularly the Right to a Fair Trial as guaranteed by the Constitution. By understanding the legal perspective, implementing effective detection methods, and taking preventive measures, we can create a more secure financial landscape. These strategies not only protect individuals but also foster trust in our economic systems, ensuring fairness and transparency for all.